Last Updated: 20th August,2021

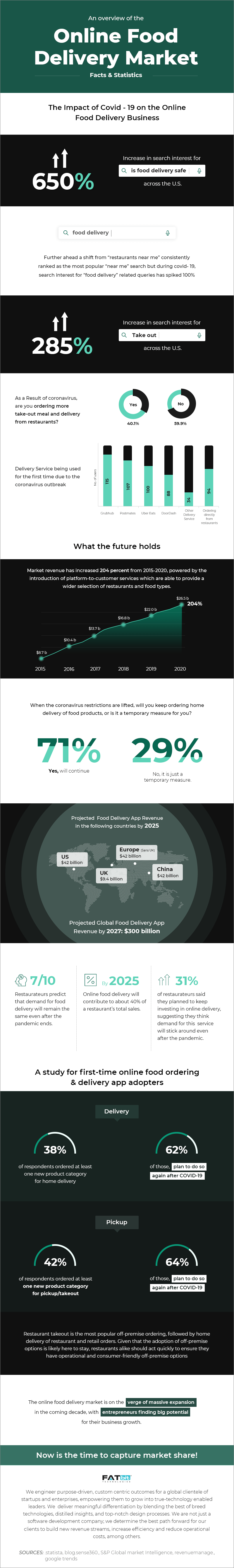

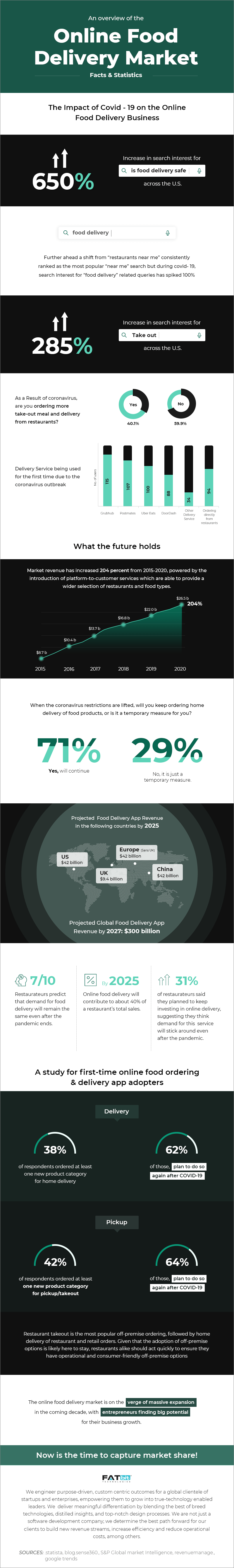

The COVID-19 outbreak brought radical changes to consumer behaviour in the food industry. The fear of getting infected may fade once the pandemic ends but changes that leave positive impacts are likely to last in the future. From digital adoption to health awareness, it is estimated that many recently adopted behaviours may become the norm.

Entrepreneurs looking to make hefty investments in the food industry must understand consumers’ preferences and food industry trends that may last in the future post COVID-19. To help entrepreneurs that rely on facts & statistics make important business decisions, we’ve listed some popular food industry trends in this blog post that may stick around for the long term.

Food Industry Trends that May last beyond the COVID-19

Below-listed are some prominent food industry trends that are expected to persist in the future:

1. Rising Demand for Online Food Ordering Services

The COVID-19 pandemic has increased the usage of online food delivery services. According to surveys conducted by the following websites, people are likely to use online food delivery services in the future after the COVID-19:

- A report released by the National Restaurant Association in January 2021 revealed that 53% of the U.S. adults believe that purchasing online food and takeout are new norms and are essential to the way they live in today’s era. Moreover, 68% of U.S. consumers said that they are more likely to use online food delivery services than they were utilizing even before the pandemic.

- According to the UK-based research consultancy CGA, 60% of the UK-based customers, who use online food delivery services for the first time after the COVID-19, said in a survey that they would continue to use online food delivery services in the future to satisfy their hunger pangs.

-

As of the April 2020 survey conducted by Statista in Russia, almost 70% of Russians had the intention to continue using online food delivery services after the relaxation of COVID-19 restrictions imposed by the government. Another report by Statista revealed that 80% of Malaysian residents aged between 35 and 44 would continue to order food through online platforms even if restaurants are open and social distancing measures are lifted.

- Considering the changing consumer behaviour in the current scenario, the total revenue of online food delivery apps in the U.S. is projected to amount to 42 billion US dollars by 2025, according to BusinessofApps.

2. Increased Adherence to Safety Protocols

According to a report, search results on the web across the U.S. for “is food delivery safe” increased 650% in March 2020. Even after the arrival of the COVID-19 vaccines, many people are still concerned about their safety. To keep their customers and staff protected from the COVID-19, it is estimated that both restaurants and food delivery platforms will continue to follow the below-listed safety practices in the post COVID-19 future:

Safety Protocols Followed by Food Delivery Platforms

- Providing an option to customers to search and sort their favourite restaurants by hygiene ratings.

- Listing only those restaurants on the platform that strictly follow food hygiene practices. According to Food Safety News, food delivery giants like Deliveroo and Uber Eats decided to partner with restaurants that have hygiene ratings of at least 2 stars. Moreover, the platforms are also encouraging restaurants with lower hygiene ratings to make improvements to their safety standards.

- Sharing timely updates with customers to make them aware of operational working hours of restaurants, food delivery policies, and safety measures followed by the delivery staff.

- Using tamper-evident delivery bags for maintaining the food quality and providing safer food delivery services to customers.

Safety Protocols Followed by Restaurants

- Disinfecting door handles, touch screens, utensils, payment systems, dining tables and all other primary touchpoints in the restaurant.

- Implementing workplace controls like temperature tracking, social distancing, face mask compulsion and more.

- Using hot water for cleaning the floor and washing utensils.

- Reducing cross-contamination by keeping the cooked food separated from the raw food.

- Using sign boards with a message like “Our staff is screened for any symptoms of illness before working today” to keep customers aware of the safety guidelines followed at the restaurant.

- Equipping the staff with personal protective equipment such as sanitizers, masks, and gloves.

3. Persistence of Contactless Delivery Options

Many people prefer to opt for contactless delivery options while placing their order due to the fear of getting infected by the COVID-19. A research conducted by sense360 explained that 42% of the US consumers selected takeout delivery options while ordering online since the COVID-19 began and 64% of those are expected to sustain this behaviour in the future after the pandemic ends.

As of June 2021, 25.3 % of the global population has received at least one dose of the Coronavirus vaccine. According to a report by the World Economic Forum, at least 60% of the people from countries like Germany, Italy, the U.S., the UK and more are still eager to follow social distancing practices in the future even after getting vaccinated.

Though many people may continue to adhere to social distancing measures, it is expected that the following contactless delivery options would persist in the coming future:

-

Digital Payments: Allows customers to pay the order amount online via net banking, credit or debit cards, and e-wallets.

-

Curbside Pickup/BOPIS: Enables customers to place an order online and collect it from the pickup location.

4. The emergence of Differential Pricing Options for Restaurants

The COVID-19 outbreak has adversely affected sales of local restaurants over the last year. To support small and mid-sized restaurant owners in these trying times, many food delivery companies have decided to make significant changes to their revenue model.

For instance, DoorDash recently came up with a differential pricing model in which restaurants can set commission fees to be paid to the platform on every order delivery. Previously, restaurants had to pay a fixed commission charge to DoorDash on every order placed and delivered.

But as per an article published in The Wall Street Journal, restaurant owners now have an option in which they can select commission charges from 15%, 25%, or 30% as per their requirements. Marketing support would be offered to the restaurant based on different fee levels.

In a virtual event, DoorDash’s COO Christopher Payne revealed that the company has decided to offer differential pricing options considering the demand of their partnered restaurants. Here is his official statement:

“This is what we’re doing by listening to our merchant partners and making adjustments. Basically, we’ve been learning together what a restaurant needs and testing the way what the next stage of pricing should be.”

If DoorDash witnesses an increase in their sales volume in the coming days due to its updated revenue model, then it is estimated that other food delivery giants would follow suit.

5. The surge in the Adoption of Ghost Kitchen Models

Prior to the COVID-19 pandemic, the concept of setting up a ghost kitchen was already gaining momentum where restaurants would hire a space for the preparation of delivery only meals. After the COVID-19 outbreak, ghost kitchens experienced a parallel upswing alongside contactless deliveries and takeaways. The ghost kitchen concept has offered many restaurant owners a much needed relief and helped them recoup their losses during the nationwide lockdown.

The global ghost kitchen market is estimated to reach 71.4 billion US dollars by 2027, according to Statista. Starting a ghost kitchen doesn’t require startups to invest a hefty amount of time and money when compared to opening a full-service restaurant. Considering the rising growth of the ghost kitchen market and benefits offered by ghost kitchens such as lower setup cost & faster time to market, it is estimated that cash strapped entrepreneurs would invest in this profitable idea in the future post COVID-19.

Suggested Read: How to Choose the Right Software for Your Ghost Kitchen Business

Conclusion

Many past disruptions reveal that certain shifts in business processes and consumer behaviours become permanent once the crisis ends. For instance, the arrival of SARS in China in 2003 left a lasting impact on businesses & consumers and increased the digital adoption to a great extent. Though it is too early to say what exactly the future has in store for the food industry in the post COVID-19 world, business owners must adapt to changing circumstances to stay ahead of the game. Adopting new norms while analyzing food industry trends and paying equal attention to what consumers need will help businesses thrive in the future in the post COVID-19 era.

To help budding entrepreneurs go digital in this highly competitive food delivery market, the team of experts at FATbit technologies developed a multi-restaurant food delivery solution named Yo!Yumm. It is a fully customizable solution integrated with advanced features that enables startups and SMBs in the food industry to quickly launch their online food delivery platform. It provides an admin panel to help business owners manage their marketplace activities conveniently. It also comes with ready-made mobile apps and web portals for buyers, sellers, & delivery staff so that entrepreneurs can set up their online food ordering marketplace conveniently.

Get Consultation To Start Your Online Food Delivery Business

Comments (2)

Nadeem

Nadeem

FATbit Chef

FATbit Chef

Thanks for giving great kind of information. So useful and practical for me. Thanks for your excellent blog, nice work keep it up thanks for sharing the knowledge

You’re Welcome!

Glad you find it useful.

Keep visiting us for more such useful content.

Cheers!

Team FATbit.